How To Get Views On YouTube Shorts? Your Ultimate Guide

Jan 16, 2026

Jan 16, 2026

Jan 16, 2026

Jan 15, 2026

Jan 15, 2026

Jan 15, 2026

Jan 14, 2026

Jan 13, 2026

Jan 13, 2026

Sorry, but nothing matched your search "". Please try again with some different keywords.

Advancements in digitalization have transformed various industries. And, one such industry is financial technology, or as more commonly known— fintech.

It offers different kinds of digital services to help both businesses and consumers manage their financial operations efficiently.

However, with every emerging technology comes certain challenges. And, for the fintech services, it is the error codes.

You will find these messages appear during a financial transaction or while checking your account details, indicating an issue with the digital link.

Even though it is frustrating when you encounter them, it is important to know what each codes mean and how to resolve the issues.

So, in this blog, I am going to explore the common Fintech Asia error codes by delving into—

Stay tuned!

FintechAsia error code is a common issue that happens on diverse financial platforms operating in the Asian region.

It refers to the pop-up messages that appear during a failed transaction, account verification, or API integrations. Indicating the issue behind the failed operation.

Although there is no fixed cause found for the repeated appearance of the error codes, it generally happens because of poor network connection, system bugs, or login issues.

Even though the exact reason behind the appearance of the error codes is not found, here are a few common reasons.

Here are some specific codes for common errors that you can resolve easily.

| Codes | Meaning | Reason | Solution |

|---|---|---|---|

| 101 | Invalid card details. | Card number, CVV, or expiry date don’t match or are incorrect. | Re-enter the correct card details. |

| 202 | Insufficient balance. | Not enough funds in the account for transactions. | Use a different account for transactions or recharge the main account. |

| 305 | The gateway for the transaction is not available. | Maintenance or technical issues in the platform. | Wait for the gateway to restore before trying the transaction. |

| 401 | Unauthorized account access. | Login details don’t match, or the session has expired. | Either verify your credentials or change your login details. |

| 403 | Account access denied. | Accessing restricted content without permission. | Check the account settings. |

| 429 | Multiple requests. | Multiple actions are taken from a single account or IP address. | Wait for the time. Then, try again to take the actions. |

| 510 | Duplicate transaction. | Same transaction request submitted more than once. | Review the duplicate transaction details and adjust the history. |

| 520 | Transaction failed due to out-of-range amount. | The transaction amount is beyond the limits mentioned in the platform regulations. | Customize the limit for your needs or make multiple transactions. |

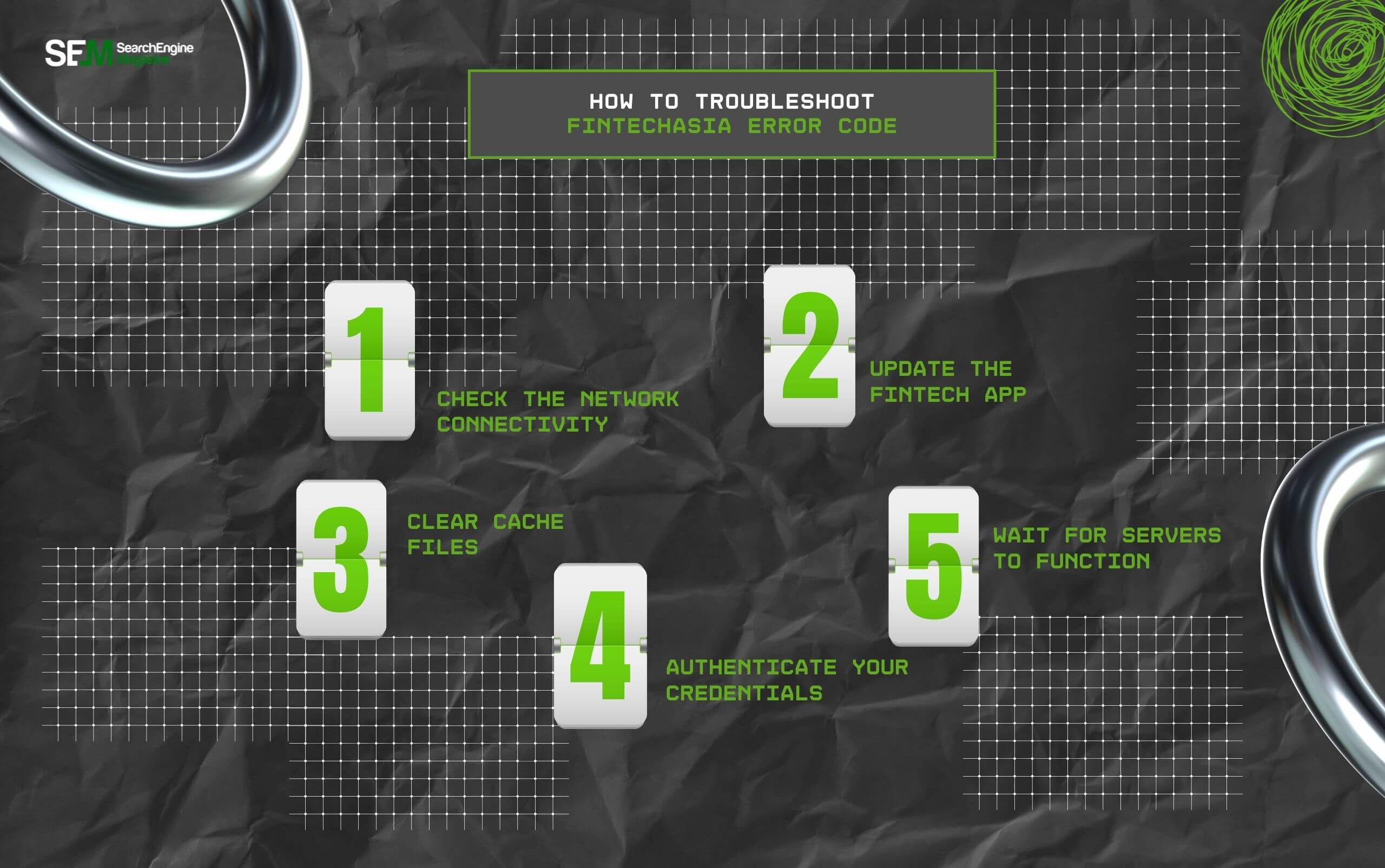

Given that FintechAsia error codes are quite common, you can encounter them anytime. So, follow the steps below to fix the error.

First things first, an unstable and poor network connectivity can affect the fintech services. So, make sure you have access to good, reliable, and stable internet.

Also, if you are regularly facing error codes indicating an unstable network, try restarting your router or switching to a different network provider.

An outdated app cannot function properly. Giving you multiple error codes for basic glitches and bugs. So, keep your app updated with the new version to avoid getting error codes.

If you are using the web version of FintechAsia, you need to clear the cache and website cookies. That is, you can clear out the space for the app to function.

Additionally, removing the cookies and cache can help in smoothing the transaction process and resolving performance-related issues.

If you are getting error codes for account access issues, you can verify your account using multi-factor authentication.

Moreover, changing the password and login ID regularly can help avoid access issues.

In addition to this, with server-down issues, you just have to wait for the platform to fix the backend problems.

However, if the issue persists or regularly happens, try contacting the support team to resolve the server-related problems.

Other than that, taking the right measures now can essentially reduce the chances of encountering the FintechAsia error codes in the future.

So, some of these preventive measures are:

Given that error codes are common for almost all FintechAsia platforms, resolving them by following the step-by-step guide is quite easy.

However, if the issue persists, then it’s better to contact the customer support.

So, when you encounter an unknown error code, regular failed transactions, and have tried all tricks but nothing is working, then you can call in the experts.

Moreover, with their knowledge and technical expertise, they can guide on how to resolve the issue. So, it’s better to seek professional help and fix the problem in seconds.

Even though seeing a FintechAsia error code is frustrating, they are here to help. By indicating the issue, they are helping you understand what is blocking the operations.

And, based on the exact meanings behind the error messages, fixing the exact problem is easier than finding the problem in a haystack. So, instead of fearing them, why not try understanding them?

Moreover, decoding the messages properly can resolve the issues faster and make the app efficient. Making the app useful for managing financial operations.

So, the next time one of them pops up on the screen, just solve it!

The payment error codes differ from platform to platform. However, some of the common codes that are the same across most platforms are—

• 305— No payment gateway available.

• 429— Multiple transaction actions.

• 510— Duplicate transaction.

• 520— Out-of-range transaction amount.

To fix a payment error, you first need to identify what kind of payment error is showing. Then, based on the type, you can follow the resolving steps.

If the error codes keep appearing and the issues persist even after you have tried everything you can do, then it is safe to call the customer support. Also, with their support and guidance, you can easily resolve the issues.

Read Also:

Barsha is a seasoned digital marketing writer with a focus on SEO, content marketing, and conversion-driven copy. With 7 years of experience in crafting high-performing content for startups, agencies, and established brands, Barsha brings strategic insight and storytelling together to drive online growth. When not writing, Barsha spends time obsessing over conspiracy theories, the latest Google algorithm changes, and content trends.

View all Posts

How To Get Views On YouTube Shorts? Your Ul...

Jan 16, 2026

Ethereum Casino: Is This Online Gaming Platfo...

Jan 16, 2026

What Is A Key Benefit Of Display Campaign...

Jan 15, 2026

Liquidity, Security, And Accessibility: The C...

Jan 15, 2026

Swisscows: Is This Private Search Engine Wort...

Jan 15, 2026